全站搜索

Search the entire website

Search the entire website

When you search for the “top rock crusher brands,” you’ll see the same giant names repeated. They build great machines, but their rankings are often based on sheer size and marketing budgets, not on what gives your business the best return on investment. As engineers and manufacturers in this industry since 2004, we believe it’s time for a new kind of ranking—one based on the factors that directly impact your bottom line.

This 2025 expert review ranks the world’s 10 leading rock crusher manufacturers on what truly matters: unbeatable value, customization flexibility, and direct, expert support. In today’s competitive market, the smartest investment isn’t always the biggest brand name. It’s the brand that gives you a direct partnership, tailoring solutions to your exact needs without the premium price tag.

Traditional rankings often stop at performance. We go deeper, evaluating brands on the complete ownership experience.

Here is our breakdown of the industry leaders, evaluated through the lens of what matters most to your profitability.

It might be surprising to see us at number one, but according to our value-first criteria, the choice is clear. Our factory-direct model is specifically to eliminate the inefficiencies that plague the traditional market, delivering unmatched value directly to our clients. You invest in steel and engineering, not in dealership overhead.

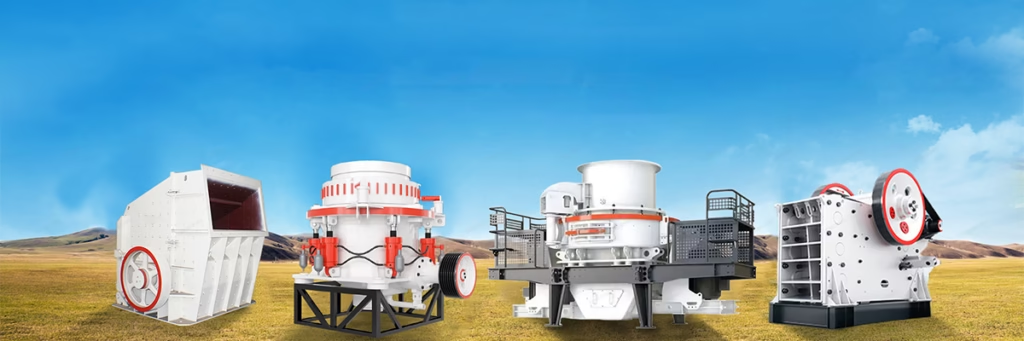

Our 15-person engineering team works directly with you to design a complete crushing plant or a standalone machine tailored to your exact needs. When you need support, you speak directly with the engineers who designed your equipment, ensuring faster, more accurate solutions. Founded in 2004, our 8,000 square meter factory uses advanced CNC machines and high-grade steel to build robust equipment that has exported to over 120 countries, from high-capacity jaw crushers to efficient mobile plants.

Metso has earned its reputation as a global leader through decades of high-level performance and innovation. Their Nordberg® and Lokotrack® series are benchmarks for quality and are packed with the industry’s most advanced automation and predictive maintenance features.

However, this top-tier performance comes at the industry’s highest price point. The value is there for massive operations that can leverage every bit of their advanced automation, but it’s less accessible for smaller or mid-sized producers. Support from their excellent global dealer network is strong, but this service comes at a premium for both parts and labor, impacting your total cost of ownership.

Sandvik is a direct competitor to Metso and a giant of Swedish engineering. They lead the charge in “smart” crushers, with a focus on data and remote operation through their SAM automation system. Their machines are for exceptional reduction ratios and efficiency.

Similar to Metso, Sandvik offers exceptional performance for a premium price. Their 800i series offers a great cost-per-ton if you utilize all its features, but the initial investment is substantial. You are buying into a highly refined set of standard equipment with many configurable options, but your total cost of ownership must factor in the world-class (and world-class priced) support network.

Sany is a major Chinese heavy equipment manufacturer that has rapidly expanded its global presence and now offers a full range of crushing equipment. Their primary advantage is offering a single-brand solution for operations that already run Sany excavators, trucks, and loaders.

Their crushers provide good performance and solid durability, built to the same standards as their other well-regarded machinery. While they are adopting modern features, their main value proposition is for those who are already in the Sany ecosystem. The a la carte value is less compelling than a specialized, factory-direct manufacturer.

Kleemann represents the best of German engineering, with a focus on fuel efficiency, operator comfort, and impeccable build quality in their mobile units. Their SPECTIVE control system is intuitive, and features like the Continuous Feed System (CFS) optimize performance and save on diesel.

This precision comes with a high initial investment. However, their low operating costs can lead to an excellent total cost of ownership over a long period. They are backed by the enormous Wirtgen/John Deere network, which provides excellent but costly support. The focus is on highly optimized standard mobile plants, not custom stationary solutions.

Astec is a major American manufacturer that owns legendary brands like Telsmith and KPI-JCI. Their reputation is built on one thing: extreme durability. Their equipment is famously over-engineered, built like a tank, and designed to last for decades, especially in hard rock applications.

The trade-off is that they are more traditional, focusing on incremental improvements in durability rather than cutting-edge automation. Their value proposition is strongest in North America, where their dealer support is robust. For international buyers, the value equation can be more challenging compared to factory-direct options.

Terex is a dominant force in the mobile crushing and screening market, known for producing reliable, high-volume machines for contractors. Their brands Powerscreen and Finlay are workhorses, built to be moved frequently and set up quickly.

They offer a strong value proposition within the mobile category. Their machines offer a good balance of price and performance for their intended use. However, their business model is built around a standard range of mobile equipment sold through dealers, offering limited customization for site-specific or stationary needs.

Keestrack, a Belgian company, has carved out a niche as a key innovator in sustainability. They are a leader in developing hybrid and fully electric-drive mobile crushers, appealing to companies focused on reducing their carbon footprint and fuel costs.

Their performance is very good, and they offer versatile, multi-stage mobile plants. As a more specialized European manufacturer, the initial cost can be high, and their global support network is still growing compared to the giants. Their value matches directly to the fuel and emissions savings their electric technology provides.

While famous for excavators and loaders, the Japanese giant Komatsu also produces a line of highly effective mobile crushers. Their key advantage is creating a seamless, all-in-one-brand ecosystem. Their mobile crushers are designed to work perfectly with Komatsu excavators and loaders.

The durability is excellent, as expected from Komatsu. However, the crushers themselves are not always considered best-in-class on a standalone basis. You are paying for the convenience and reliability of the Komatsu name and the integration with their broader product family and global service network.

McLanahan is a classic American brand with a history dating back to 1835. They do not compete in the mass market for jaw or cone crushers. Instead, they excel at building incredibly robust, custom-engineered solutions for very specific applications, such as roll crushers, sizers, and sampling systems for coal and other industrial minerals.

Their support model is highly specialized, based on direct factory expertise. Their equipment is exceptionally durable but designed for a narrow range of tasks. They represent the ultimate in custom solutions for niche problems, but they are not a general-purpose crushing brand.

While the global giants make fantastic equipment, their business model requires you to pay for far more than just the machine. You pay for their marketing, their complex distribution channels, and their dealers’ profits.

In 2025, the smart choice is to bypass this system. By partnering directly with a manufacturer like ZONEDING, you get a solution built for your business, backed by the people who know it best, at a price that accelerates your return on investment.

If you’re ready to stop paying for a brand name and start investing in performance and partnership, we invite you to talk directly with our engineering team today.

Follow limestone journey from raw material to finished product! This blog provides a detailed breakdown of each processing stage, from crushing to screening.

View detailsDiscover 9 most common problems on ball mill, from excessive wear to power consumption. Learn how to identify issues and implement solutions to extend lifespan.

View detailsThis blog gives a detailed explanation of grinding mill's definition, types, applications, working principles, and key functions in material comminution.

View detailsTransform slag into valuable aggregates with our slag crushing machines. Maximize your ROI by turning industrial waste into road base or construction sand.

View details