全站搜索

Search the entire website

Search the entire website

Gold is unique among global commodities. Unlike oil, which is burned, or copper, which oxidizes and disappears into landfills, gold is virtually indestructible. Almost every ounce of gold ever mined in human history still exists in some form today. This chemical immortality creates a unique supply dynamic where the “above-ground” stock accumulates permanently, while the “below-ground” reserves steadily diminish.

As of 2025, the World Gold Council and the United States Geological Survey (USGS) provide the definitive data on these numbers. Approximately 212,582 tonnes of gold have been mined throughout history. Conversely, the underground “proven reserves”—gold that is identified and economically viable to extract—stands at roughly 59,000 tonnes. This glaring disparity raises urgent questions for the mining industry, investors, and industrial consumers. Are we approaching “Peak Gold”? As easy-to-reach deposits vanish, how will the mining sector adapt to process lower-grade ores? This analysis explores the geological reality of gold supply and the mechanical innovations necessary to extract what remains.

Last Updated: January 2025 | Estimated Reading Time: 16 Minutes

To visualize the total volume of gold mined in history, imagine a solid cube of pure gold. That cube would measure roughly 22 meters on each side. While this seems incredibly small for a global asset, the density of gold (19.3 g/cm³) means this cube weighs over 212,000 tonnes.

This mined gold does not sit idle in a single location. It is distributed across four primary sectors. Understanding this distribution is key to understanding price dynamics, as “above-ground” gold can re-enter the market through recycling.

The key takeaway for the market is that gold supply is not just about mine production. Because 212,000 tonnes already exist, the recycling of old jewelry and electronics plays a massive role. When gold prices rise, “scrap supply” increases. However, to meet growing global demand, fresh mine production remains the primary engine.

While the above-ground stock is a known quantity, the underground supply is a matter of geological estimation. The USGS currently estimates global “Reserves” at 59,000 tonnes.

To understand how much gold is left, the distinction between Reserves and Resources must be clear.

If global gold production continues at the current rate of approximately 3,000 tonnes per year, the 59,000 tonnes of proven reserves represent only about 19 years of supply. This does not mean the world runs out of gold in two decades. It means that without new discoveries or higher prices that convert “Resources” into “Reserves,” production levels will inevitably decline.

The remaining gold is not evenly distributed.

“Peak Gold” is the theory that the world has reached the maximum rate of global gold production and will only see declining output from this point forward.

Data suggests the industry is currently in a plateau phase. Global mine production hit a record high in 2018-2019 and has struggled to surpass that level since. New major discoveries—termed “World Class” deposits containing over 5 million ounces—are becoming exceptionally rare. In the 1990s, the industry discovered dozens of such deposits. In the 2020s, they are scarce.

Despite record spending on exploration, the return on investment (ROI) in terms of ounces found is dropping. Miners are forced to look in riskier jurisdictions, deeper underground, or at the bottom of the ocean. This scarcity supports the long-term floor price of gold but places immense pressure on mining companies to be efficient.

The most significant trend in modern gold mining is the decline of ore grade.

To get the same amount of gold, a mining company in 2025 must mine, crush, and process ten times more rock than a company did 50 years ago. This reality shifts the focus from simple extraction to highly efficient mineral processing. The profitability of a mine now depends entirely on the cost-per-tonne of processing.

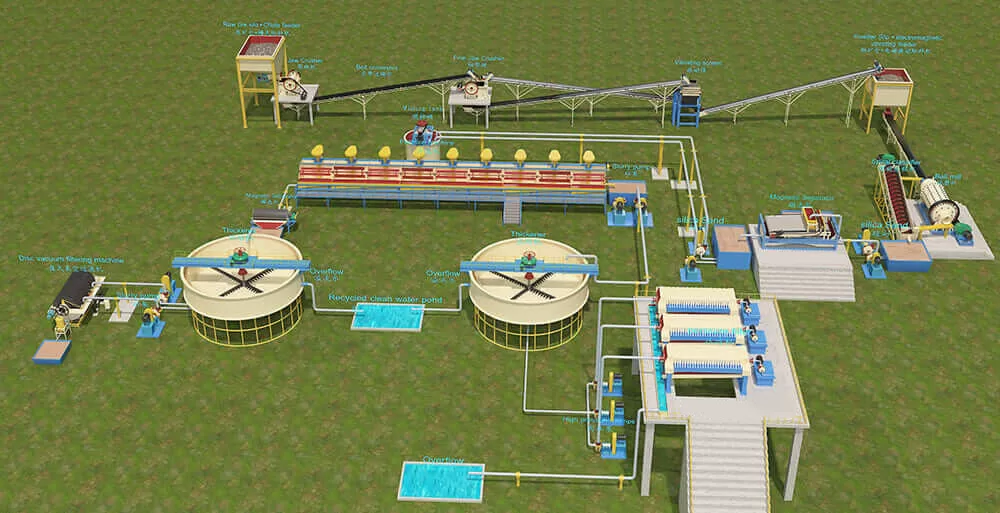

With 59,000 tonnes of gold locked in lower-grade or harder-to-process rock (refractory ore), the role of crushing and beneficiation equipment becomes paramount. ZONEDING and other manufacturers focus on providing the machinery that makes low-grade mining economically feasible.

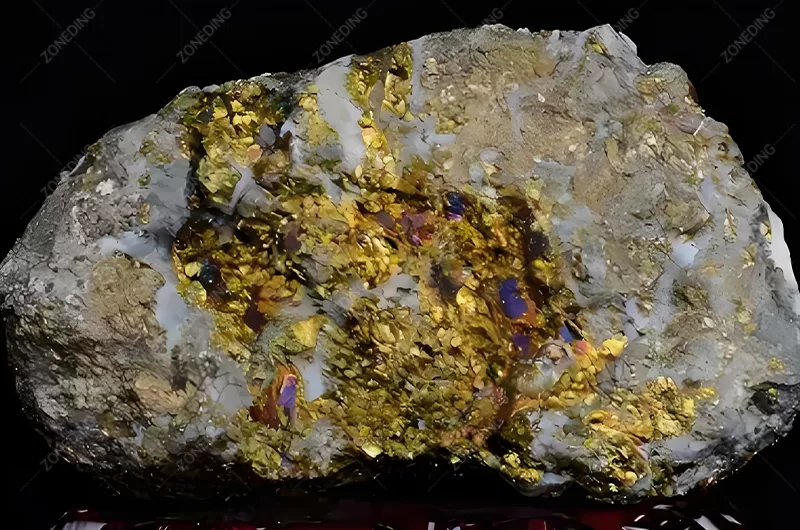

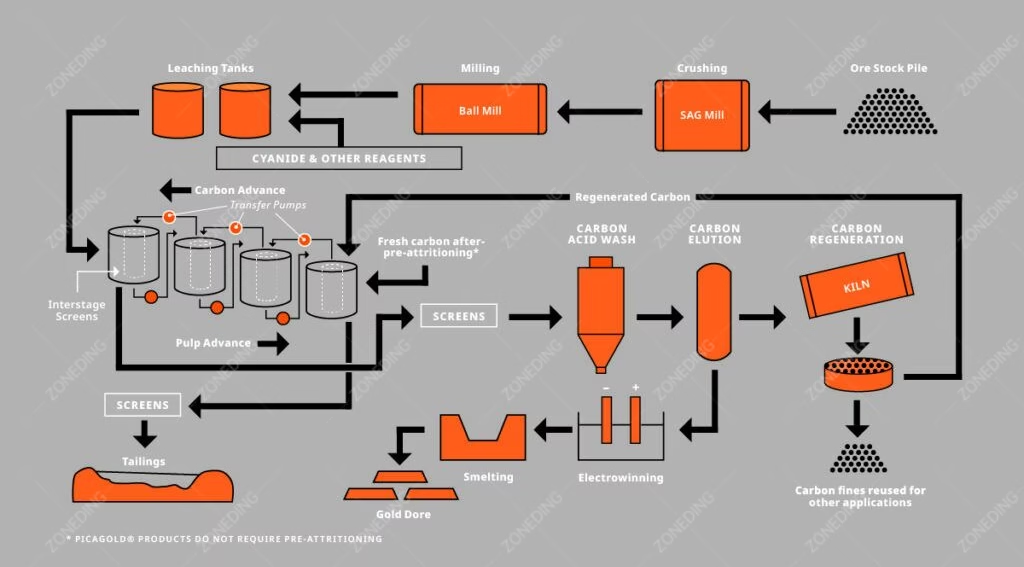

Gold is disseminated as microscopic particles inside quartz or sulfide rock. The first step is size reduction.

This is the most energy-intensive part of the process. The rock must be pulverized into a fine powder (often 75 microns or less) to liberate the gold particles.

Once ground, the gold must be separated.

| Process Stage | Equipment Required | Key ZONEDING Solution | Objective |

|---|---|---|---|

| Comminution | Jaw Crusher | PE Series Jaw Crusher | Reduce run-of-mine ore to <150mm |

| Fine Crushing | Cone Crusher | Hydraulic Cone Crusher | Produce uniform feed for the mill |

| Pulverizing | Grinding Mill | Overflow Ball Mill | Liberate 95% of gold particles |

| Separation | Flotation Cell | SF Flotation Machine | Recover sulfide-associated gold |

As terrestrial high-grade reserves dwindle, the industry looks toward unconventional sources.

The ocean floor contains vast amounts of gold, particularly in seafloor massive sulfide (SMS) deposits near hydrothermal vents. While the estimated tonnage is massive, the environmental concerns and technological costs are equally high. As of 2025, commercial-scale deep-sea gold mining remains in the experimental and regulatory phase.

A ton of discarded smartphones contains up to 100 times more gold than a ton of high-grade gold ore. Recycling electronic waste (e-waste) is becoming a substantial source of supply. However, the logistics of collecting and processing e-waste are complex. While it contributes to the supply, it cannot yet replace the volume produced by traditional mining.

While frequently discussed in media, mining asteroids for gold is technologically decades away. The costs of space travel make it economically impossible for the foreseeable future, despite the theoretical abundance of metals in space.

The numbers tell a clear story: 212,000 tonnes above ground, 59,000 tonnes viable underground. The era of easy gold is over. The future of gold supply does not rely on finding a new California Gold Rush; it relies on engineering and efficiency.

The distinct challenge for the mining industry in 2025 and beyond is processing volume. To maintain global supply levels, miners must process billions of tons of low-grade rock. This places a spotlight on the durability and efficiency of the processing plant. The Crusher must not jam; the Ball Mill must optimize energy use; the Screens must not blind.

Ready to optimize gold recovery?

Whether designing a new heap leach pad or upgrading a grinding circuit for better liberation, reliable equipment constitutes the foundation of modern gold mining.

Last Updated: January 2026

Learn From this guide to balance performance, service, and cost to ensure the best ROI for your plant. Know how to choose right milling machine.

View detailsLearn essential machines and solutions for talc beneficiation. Know about crushers, mills, flotation cells & dryers that form an efficient talc processing plant.

View detailsWhat are key differences between Hematite and Magnetite? A comparison of magnetism, streak color, chemical formula, crystal form, &iron content. Get answer NOW.

View detailsLearn how to separate minerals by magnetic methods, covering magnetic separation properties, machine types, applicable materials, and the step-by-step process.

View details